Advanced Automation Tutorials: The Momentum Strategy

The best way to explain the utility of something is often through a story. On December 4th, 2020, the price of ETH was 585.95 ETH/USD.

I was bullish, but was it too late? did I miss the move? would ETH dump down again like it had many times before?

I knew my conviction was high because I had told my Mom that it was an excellent time to buy Bluechip Crypto (BTC, ETH), something I rarely do.

Spot buys were my go-to at the time, but I knew I wanted to increase my exposure more by using a product like Multiply. But I was apprehensive mainly because of the fear of liquidation, worried that my timing might have been wrong.

Ultimately, I waited and multiplied in January 2020, when the price was around 1,200 ETH/USD, which still turned out great throughout the bull market.

When is the right time?

In hindsight, this story illustrates the perfect situation and the right time to consider the advanced automation of Auto Buy + Trailing Stop Loss.

Let’s dissect why:

- Conviction in the underlying price trend: I was sure the asset price I wanted to buy would increase significantly over the next 12 months.

- Possibility of a sudden upward price move: I knew there was a good chance that the price would unexpectedly run away from me.

- Uncertainty of a sudden downward price move: I was worried about a sudden dump that I would regret not being able to take advantage of.

The Why of Auto Buy + Trailing Stop Loss and How it Helps

- The first Multiply transaction captures the current market: The first Multiply transaction is simply buying more of the asset I have conviction in at the current price.https://docs.summer.fi/products/multiply

- Auto Buy automation captures any immediate price trend to a point: Based on my Auto Buy Automation settings, any sudden price rises will be captured by buying additional collateral up until my threshold price. https://docs.summer.fi/automation/auto-buy-and-auto-sell/auto-buy

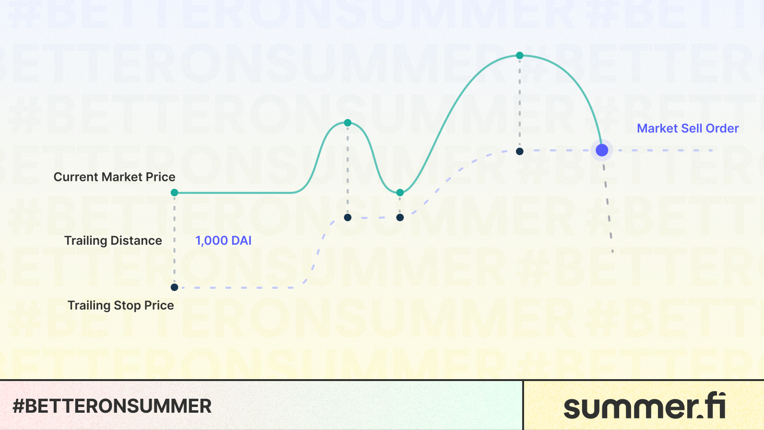

- Trailing Stop Loss protects against sharp price declines: Liquidation is protected against a sudden price drop, and profits are captured if a price drop happens after a significant price rise. https://docs.summer.fi/automation/trailing-stop-loss

This setup results in capturing momentum on the way up, protecting against losses, and capturing profits on the way down.

How to set up your Trailing Stop-Loss with an Auto-Buy

How do you do it? In the short video below, we walk through How exactly to set up your trailing Stop Loss after you have set up your Auto-Buy.

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.