Summer.fi Launches Constant Multiple

Today we announce the launch of "Constant Multiple". Another new way to automatically optimize your position in Summer.fi

Constant Multiple is an automation strategy designed to maintain your Vault at a set Multiple for your collateral exposure.

How does Constant Multiple work?

Constant Multiple automatically adjusts your Vault to a Target Multiple that you select. It does this by either selling collateral or generating more debt, in the form of DAI.

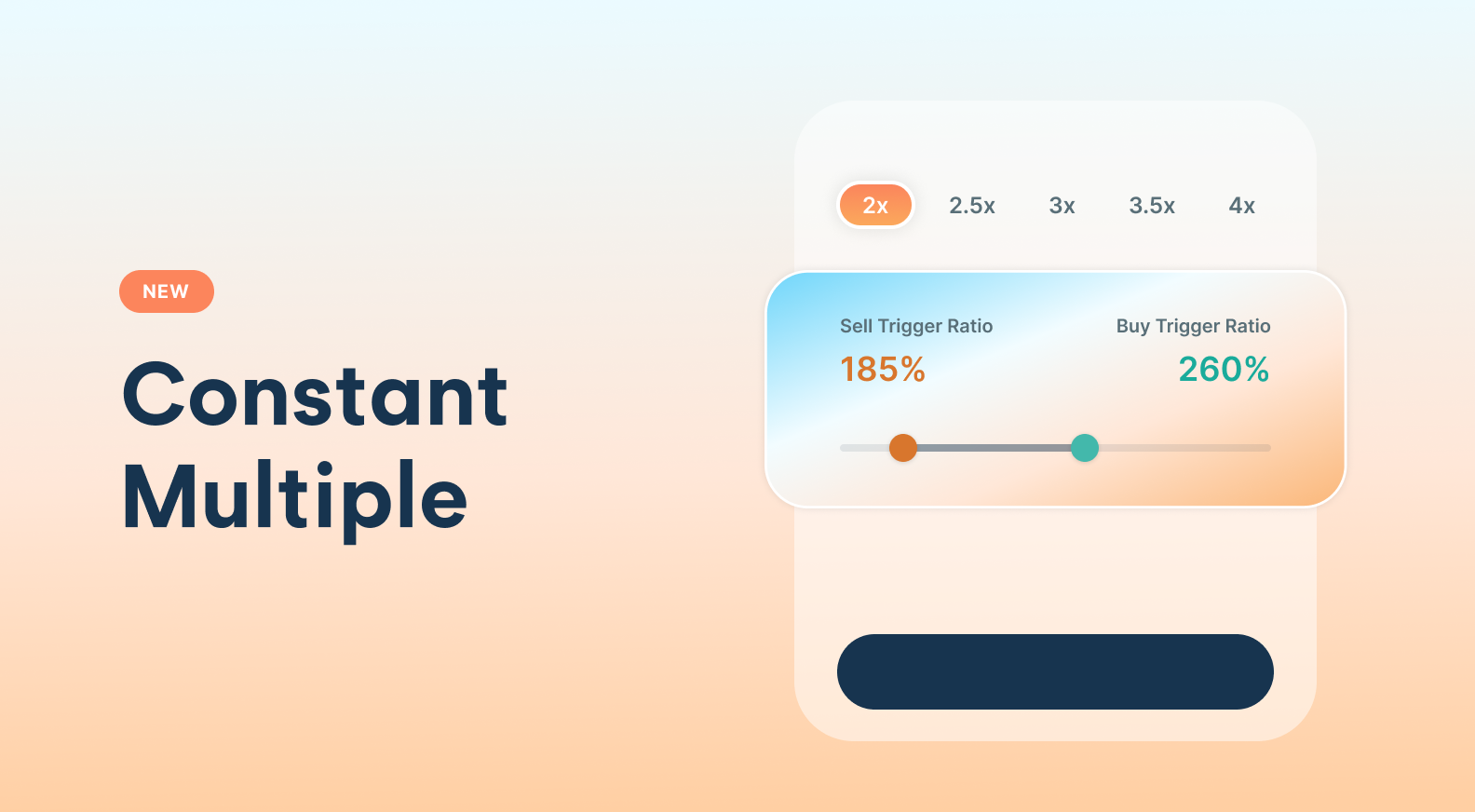

As a user, you need to select a Buy Trigger Ratio and a Sell Trigger Ratio. These collateralization ratios become the upper and lower ‘limits’. If either limit is hit, Constant Multiple will automatically adjust your position back to your Target Multiple.

Buy Trigger

If hit, your Buy Trigger will execute a "Buy Action". It will automatically generate more DAI and swap it for collateral which is deposited into your Vault. This increases your Multiple back to the target.

Sell Trigger

If your Vault's collateralization ratio hits your Sell Trigger, Constant Multiple will execute. The 'Sell Action' will sell the required amount of collateral to DAI, which is used to repay your Vault’s debt. This decreases your Multiple back to your target.

How can I use Constant Multiple?

Although Constant Multiple is an advanced feature, it is easy to set up. You need to set five parameters:

- Buy Trigger : The Collateralization ratio that will trigger a collateral buy action

- Sell Trigger : The Collateralization ratio that will trigger a collateral sell action

- Target Multiple : The Multiple that is returned to as a result of a buy or sell action

- Max Buy Price : The maximum collateral price for an automated buy action

- Min Sell Price : The minimum collateral price for an automated sell action

Please Note : Constant Multiple is an advanced automation strategy. You need to set your parameters based on your own risk tolerance and strategy.

Why use Constant Multiple?

Constant Multiple is used to maintain a Target Multiple on your Vault, even when the value of your collateral is fluctuating.

Example:

You have an Summer.fi Multiply Vault with ETH as collateral and a multiple of 2x.

You want to maintain your risk exposure at 2x and feel that ETH is in a long-term bullish trend.

As the price of ETH increases, your multiple will reduce. So to maintain your chosen multiple, you plan to buy ETH as the price rises, decreasing your Vault's Multiple to around 2x each time.

You can do this manually or set up the Constant Multiple Automation to do this for you, saving you time and effort.

Constant Multiple is a bullish strategy, but it does have a place in short-term bearish circumstances. As the name implies, it keeps your vault at a Constant Multiple.

So if your long term outlook is bullish, but you expect some short term downward price movement, you can use Constant Multiple to keep your position open and at the same multiple through any dips.

What are the Risks?

Constant Multiple is an advanced feature with risks that should be well understood before it is used.

If used correctly, Constant Multiple can be a powerful tool to help you maximize your profits without lifting a finger! However, there are some risks that you should understand before using it:

- Recurring Sell actions in a downtrending market could increase your exposure to an asset whose value is falling, the value of the asset could then rise. This could result in your ‘selling the bottom’ and losing money.

- Recurring Buy actions increase your exposure in an uptrending market, the value of the asset could then fall. This could result in you ‘buying the top’ and losing money.

However, this can all be mitigated, one of the major developments of Constant Multiple is the ability to set limits on the buy and sell prices. This means that you're not forced to sell all the way down, and can enable Stop-Loss on your Vault. And secondly, don't buy beyond a price you're comfortable with.

If you want to learn more about all Constant Multiple and the associated risks check these articles on our Knowledge Base.

Please Note: Automation isn't guaranteed to work 100% of the time.

Several factors can relate to its success. These include liquidity, volatility and gas. Learn more about automation and how Summer is building the best automation product on Ethereum →

Want more ways to optimize your Vault Strategy?

You can expect more Vault automation and optimization features in the near future. The team behind Summer.fi is working hard to ensure you have the tools you need to protect yourself from downside risk whilst maximizing your upside potential. Keep an eye on Discord and twitter for more updates on this soon.

Also, we recently started our Strategy Section of the blog, where you can find some useful tips, use cases and true stories. Read the first Strategy post.

Getting help

If you have any questions regarding Summer.fi in general, you contact us at support@summer.fi or on our social media.