A Deep Analysis of a Spark Multiply Position

In this blog, we'll explore a fascinating case study of a position involving Summer.fi Multiply and Spark, to understand how strategic moves and the right features can lead to a profitable move in DeFi.

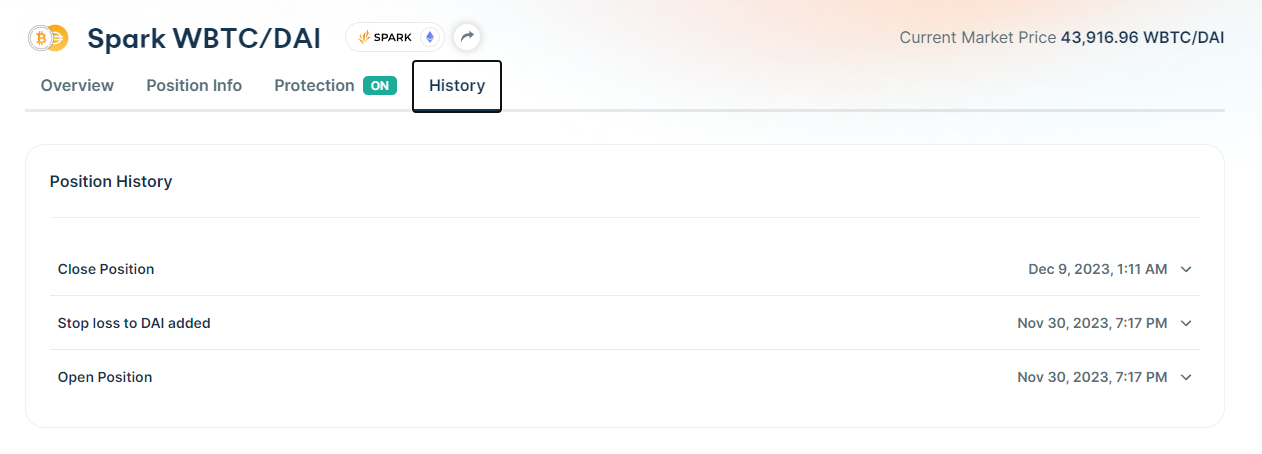

The Entry: Establishing a Multiply Position

On Nov 30th, This user began by depositing 11.67 wBTC as collateral. By using Summer.fi Multiply, he set a 2.52x multiplier. This is done by Summer.fi in a single transaction, where a flashloan is used to borrow DAI and swap for more wBTC. In this case, the borrowed amount was 665,223.19 DAI and swapped for 17.57wBTC, meaning that his total exposure was 29.24 wBTC. The Net Value of this position is 437,658.58 USD; remember this! 😎

https://etherscan.io/tx/0x134bb5ec2c31f91732bd7b0b7b02182c650e8fd8af9087cc73c8abd4e0b75a90

This means the user-controlled position is over twice the size of their initial WBTC deposit. With a loan-to-value (LTV) ratio of 60.41% and a liquidation price of 30,388.42 WBTC/DAI, the user was well-positioned, provided the market moved in their favor. In the same move, he added a Stop-Loss Automation at 72% LTV, in case the market moved in the other direction.

The Exit: Closing the Position

After 9 days, on Dec 9th, the market price of WBTC had risen to 44,171.24 WBTC/DAI, a significant increase from the opening price. This increase in value turned the trade into a profitable venture.

The profit from this trade was substantial. The initial swap of 665,223.19 DAI for 17.57 WBTC, valued at around 663,482.94 DAI at the opening price, was worth approximately 776,526.53 DAI at the closing price. This translates to a profit of about 113,043.59 DAI, not accounting for any transaction fees or interest on the borrowed DAI and not for the capital gains on his collateral.

The final Net Value of this position was 624,336.75 USD at the moment of closure!

https://etherscan.io/tx/0x96ea12f2c6e5ddf9478c7f3e78286350db93efeef3607be356c69967fcb761f9

This trade exemplifies a high-risk, high-reward use of our product. A 2.52x multiplier allowed the user to capitalize significantly on the WBTC price increase. However, it's crucial to remember the risks associated with this type of position; adding a Stop-Loss can help you mitigate those risks.

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.