How to Get the Best Out of your sUSDe with Ethena and Summer.fi

What is Ethena & why does it matter?

Ethena at its core, can be thought of as a Tokenized Basis trade. What does that mean? Let’s break it down.

A basis trade is a financial strategy with a long history. In simple terms, it's a portfolio construction in which a market participant has two opposing positions; one long, one short, to have a neutral exposure.

Generally, this is done by being long spot and short or selling futures contracts, then capturing the difference. Resulting in a delta neutral position.

Minting USDe

In the case of Ethena, USDe is minted by a whitelisted market-making counter-party who deposits mostly ETH and USDT, and also BTC and LSTsStaked ETH collateral, then Ethena transfers the collateral to delta hedge the amount of deposited Staked ETH with short ETH perpetual futures. This creates a delta neutral positioning, allowing USDe to then be minted.

Receiving 2 sources of Yield with sUSDe

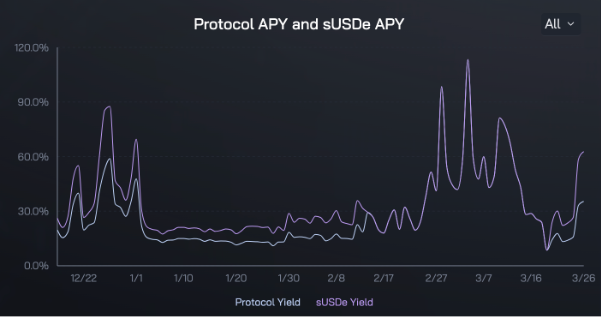

After USDe is minted, DeFi users can swap into it as they would any other popular asset. Where Ethena becomes quite interesting for many users is its two sources of yield that can be accrued by staking USDe and receiving sUSDe. At the time of writing sUSDe APY is 35.4%, but this yield can vary drastically and is determined by market forces, it is not fixed yield.

Where does the yield come from?

A common question users have for all yield bearing assets is where does the yield come from?

Ethena has two main sources of its variable, market driven yield.

Yield source one: Ethereum Staking Yield

The first source of yield for sUSDe holders is Staked ETH yield from the deposited collateral that is deposited in order to mint USDe.

Yield source two: The funding rate from the delta hedging derivatives positions

The second source of yield is derived from perpetual futures funding rates. Its important to note that funding rates can move sharply during times of market volatility. At times being extremely positive when there is lots of demand to be long, and it can also go negative when there is overwhelming demand to be short.

This means that sUSDe, at periods of time can have a very low yield. Ultimately. funding rates usually revert closer to zero or positive and display mean-reverting characteristics.

The magic of tokenization

Basis trades are not new. Basis trades in crypto are also not new. What is new, and extremely useful for DeFi natives like you is to have a tokenized version of a yielding basis trade that can be used throughout DeFi.

That means, you, as DeFi user now have a market driven yield bearing asset that you can, post as collateral, borrow against, put it into a AMM and much more …

How can you benefit from Ethena on Summer.fi?

Now that we’ve covered the basics of Ethena, USDe and sUSDe, let's get into how you can use these assets to your benefit!

First let's cover the general ways that you can use Summer.fi to get the most out of Ethena, USDe and sUSDe, then we’ll talk about those juicy rewards.

Yield focused Summer.fi strategies

sUSDe Yield Loops:

What it is: Using sUSDe as collateral, borrowing against it, and increasing exposure to the sUSDe yield.

How to do it: Use summer.fi multiply for sUSDe here →

What's in it for you: Increased sUSDe yield.

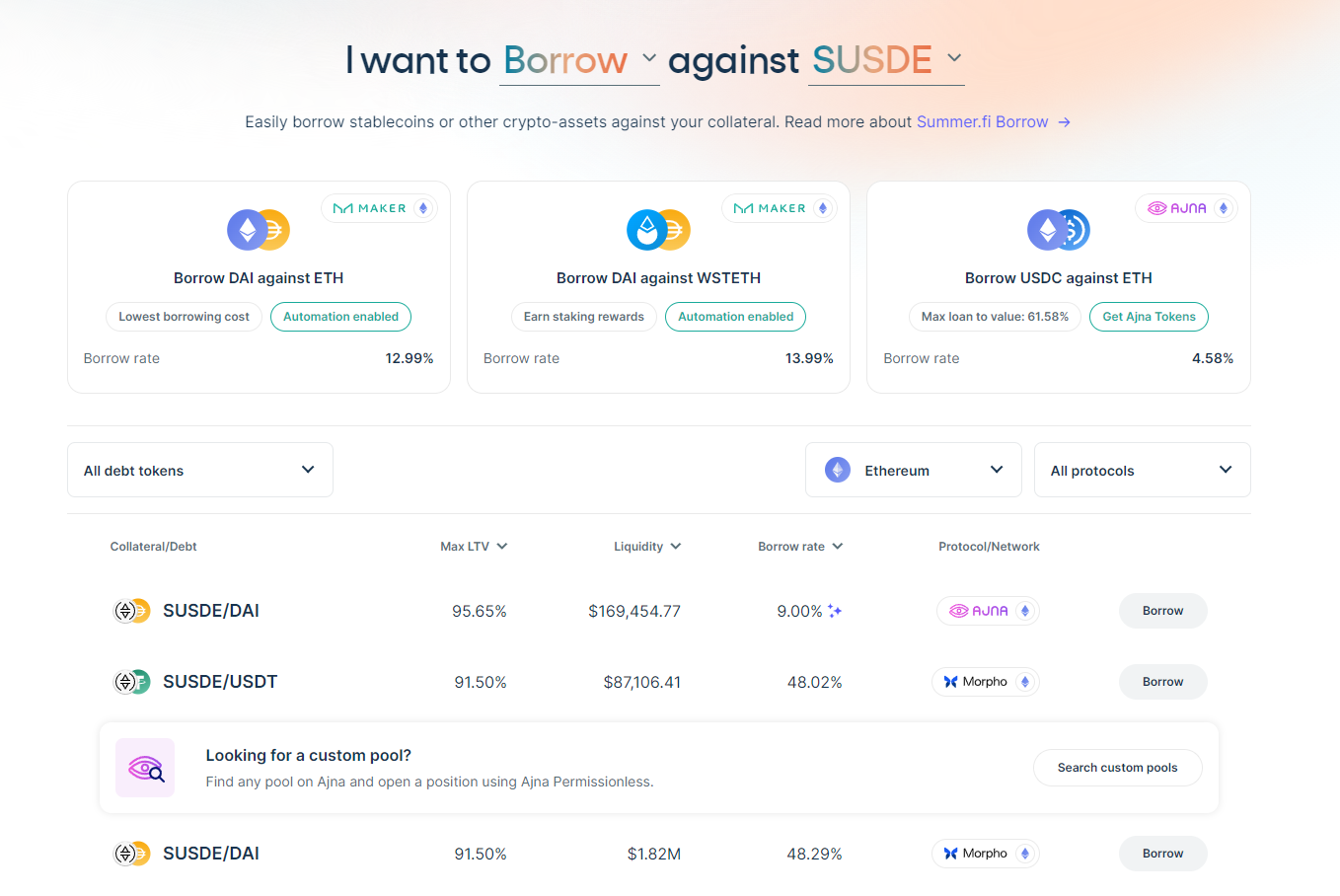

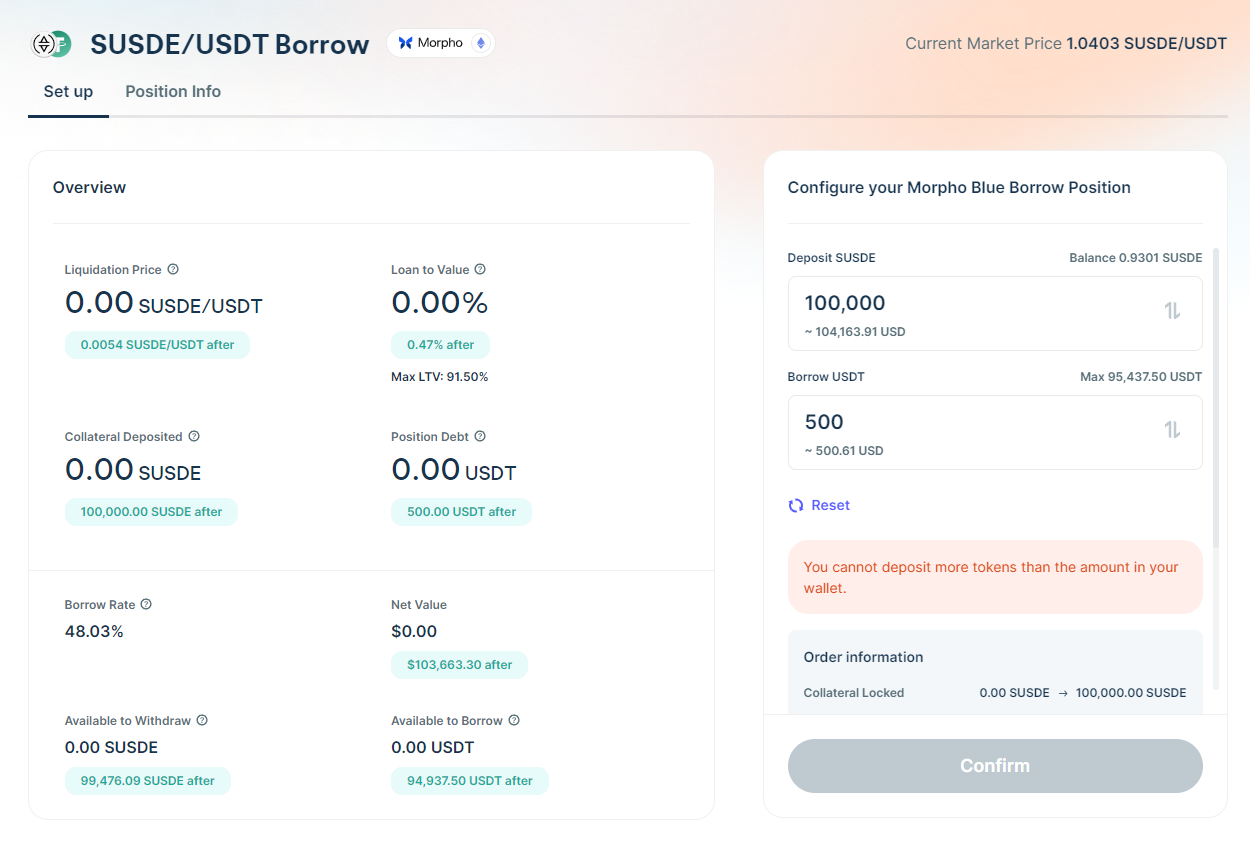

sUSDe Borrowing

What it is: Using sUSDe as collateral, borrowing against it, and using the borrowed asset while maintaining exposure to sUSDe yield.

How to do it: Use summer.fi borrow for sUSDe here →

What's in it for you: Liquidity for your sUSDe while maintaining exposure to sUSDe yield.

Borrow vault Arb

What it is: Borrow against the crypto assets you love and get exposure to fixed rate sUSDe yield on Pendle.

How to do it: Use summer.fi to borrow againt any asset that you own, then deposit the borrowed assets into Pendle sUSDe for a higher rate of return over the same duration.

What's in it for you: Maintain exposure to your crypto assets, but get access to sUSDe boosted yield.

$ENA farming-focused strategies

Summer.fi strategies focused on Sats points accumulation and $ENA farming, based on the $ENA Airdrop Sats Season 2 campaign.

USDe Yield Loops

What it is: Using USDe as collateral, borrowing against it, and increasing exposure to the USDe points exposure.

How to do it: Use summer.fi multipy for USDe here →

What's in it for you: 20x Sats points and increased $ENA rewards.

USDe Borrowing

What it is: Using USDe as collateral, borrowing against it, and using the borrowed asset while maintaining exposure to USDe 20x sats points and $ENA rewards exposure.

How to do it: Use summer.fi borrow for USDe here →

What's in it for you: Liquidity for your USDe while maintaining 20x Sats points and increased $ENA rewards.

$ENA Carry trade

What it is: Using any crypto collateral you own, borrowing against it, and using the borrowed asset to swap to USDe then lock USDe for 20x sats points and $ENA rewards exposure.

How to do it: Use summer.fi borrow against any supported collateral you own, then swap and lock USDe.

What's in it for you: Maintain exposure to the portfolio crypto assets that you love, get liquiidty, and get exposure to 20x Sats and $ENA rewards.

Ethena has grown quickly and is bringing more sophisticated financial strategies on chain. That does not mean it is without risks. For a detailed breakdown of the known risks please see their risk disclosures in detail. And as always… do your own research.

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.