Take Advantage of Trailing Stop-Loss on Aave

Today, we unveil the most advanced automation YET and announce that the beloved Stop-Loss is also available on L2s!

Cryptocurrencies are widely known for their decentralized aspect, novel tech, and of course…volatility. This is where the concept of a trailing stop loss comes into play, a powerful tool designed to protect your gains and limit your losses without constant market vigilance.

What is a Trailing Stop Loss?

At its core, a trailing stop loss is a dynamic form of stop-loss order that automatically adjusts to the price movements of an asset. Unlike a standard stop loss, which is set at a fixed price, a trailing stop loss moves with the market price, offering a flexible approach to risk management.

Setting Up a Trailing Stop Loss

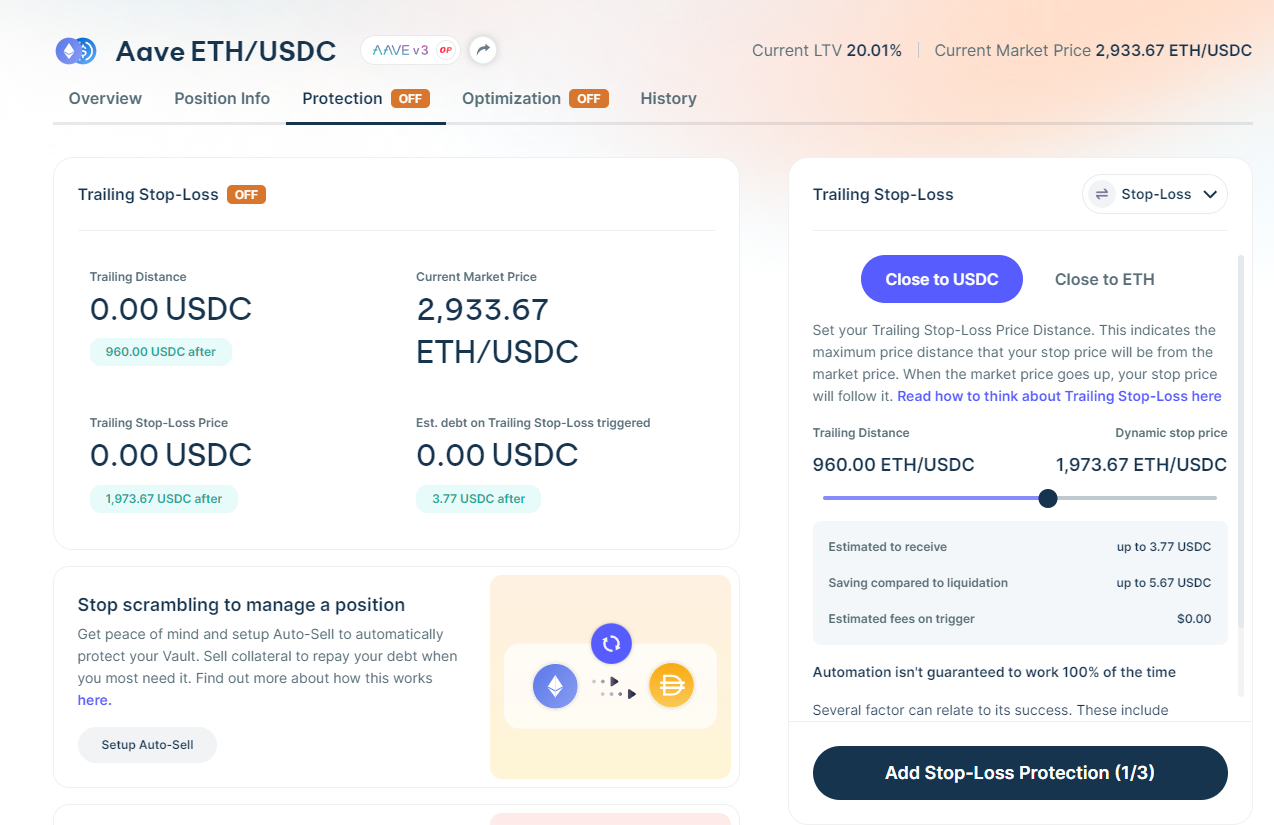

Getting started with a trailing stop loss is straightforward; steps below:

Choose a Trailing Distance: The difference between the current market and stop loss prices. For example, if you're trading ETH/USDC and set a trailing distance of 100 ETH/USDC with the current market price at 2000, your stop loss would initially be at 1900 ETH/USDC.

Adjustment Mechanism: As the market price increases, so does the stop loss price, maintaining the set trailing distance. If the market price goes up, your stop loss price will follow, but if the market price drops, the stop loss price stays put. This ensures that the stop loss only moves in one direction: in favor of locking in your gains.

How It Works in Practice

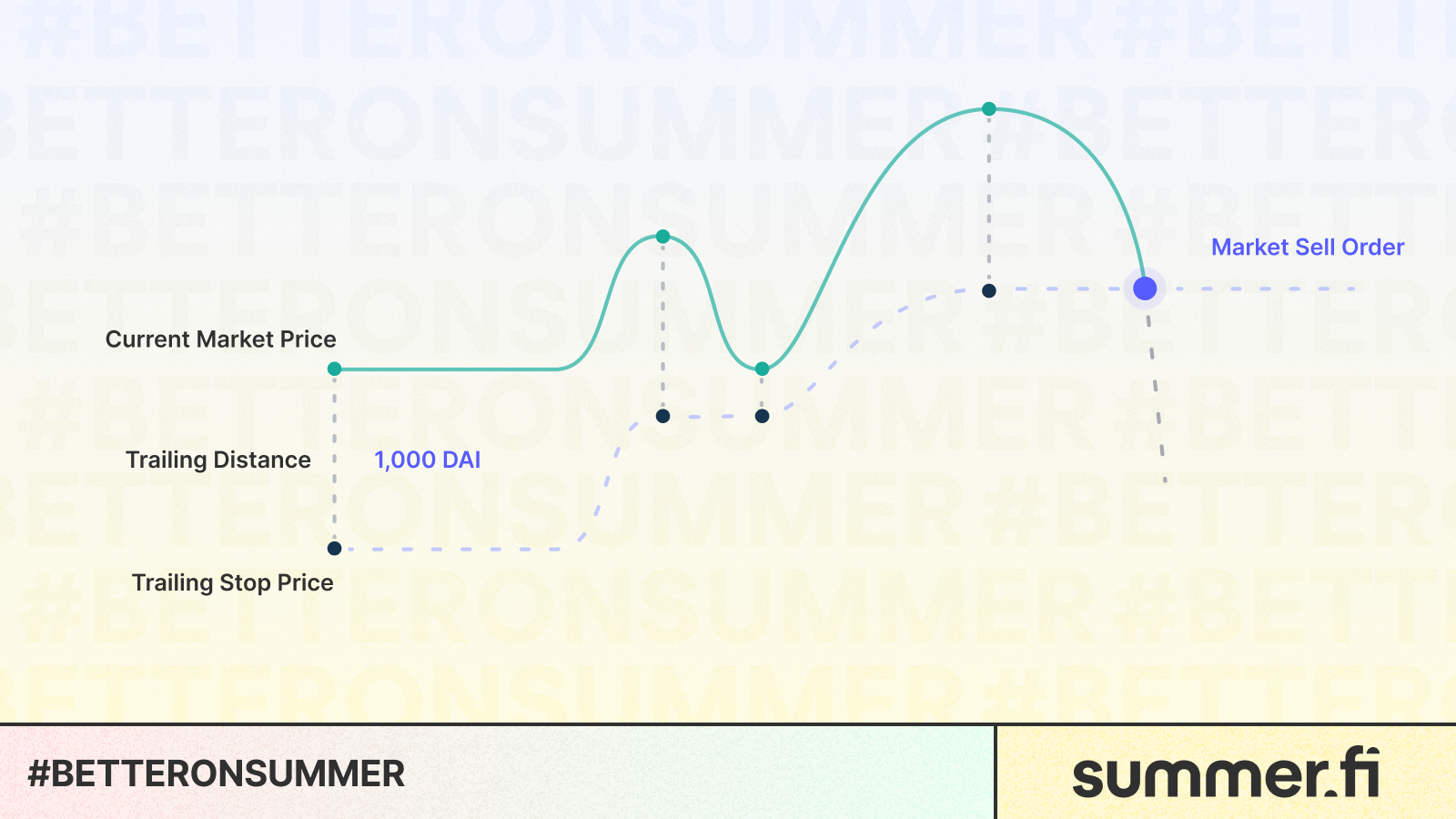

Imagine you've set your trailing stop loss with a trailing distance of 100 ETH/USDC:

Day 1: With the initial setup, if the market price is 2000, your trailing stop is at 1900.

Day 2: If the price jumps to 2200, your stop loss adjusts up to 2100.

Day 3: If the market dips to 2150, your stop loss remains at 2100.

Day 4: With a new high of 2300, the stop loss moves up to 2200.

Day 5: If the price falls below 2200, the trailing stop loss triggers a sell order.

You can modify your position at any time, but doing so resets the trailing stop loss to reflect the current market price minus the trailing distance.

Why Use a Trailing Stop Loss on Summer.fi?

1. Protection of Gains

One of the key benefits of a trailing stop loss is its ability to secure profits. As the price of an asset increases, the stop loss escalates correspondingly, ensuring that if the price suddenly reverses, a portion of the gains are preserved.

2. Limiting Losses Without Constant Monitoring

The beauty of a trailing stop loss lies in its automation. Once set, it diligently follows the price, adjusting to your predefined settings. You don't have to glue yourself to the screen, watching every tick. If the market turns against you, the trailing stop loss acts on your behalf, executing the sell order at the optimal moment.

3. Removing Emotional Decision-Making

Investing can be emotional, often leading to rash decisions based on short-term market movements. A trailing stop loss removes this emotional component, ensuring that sell decisions logically and systematically align with your initial investment strategy.

4. Summer.Fi’s security

On Summer.fi, we developed a fully non-custodial trailing Stop-Loss. Our smart contracts continuously validate the eligibility of the trailing stop loss, and it can only be executed if there is a valid execution possible.

Stop-Loss is now available on Aave for all networks

You thought we were over? WRONG!

Our widely used classic Stop-Loss is now available for Aave on all networks, this is our most used automation, and it will let you go on a holiday without worrying about your position. More information about Stop-Loss in our docs: https://docs.summer.fi/automation/stop-loss

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.