Why borrow against your crypto?

Today, we'll explore several ways and reasons why you should borrow against your crypto instead of selling using Summer.fi. There is more than one reason you, as a user, might want to get some liquidity but still hold your crypto; this is where lending protocols come into the game, and Summer.fi, as an aggregator of the most trusted ones, is the place to go.

Scenario 1: Making a Significant Purchase

Are you dreaming of acquiring a home or vehicle without sacrificing your crypto assets? Here's a solution: instead of selling, place your cryptocurrency as collateral in a Borrow vault, securing a stablecoin loan for your purchase. Remember, repayment is necessary, but it allows you to retain your crypto investments.

How can you do this in Summer.fi:

- Determine the cost of the asset you're eyeing.

- Select the cryptocurrency you prefer not to sell, like WBTC or ETH.

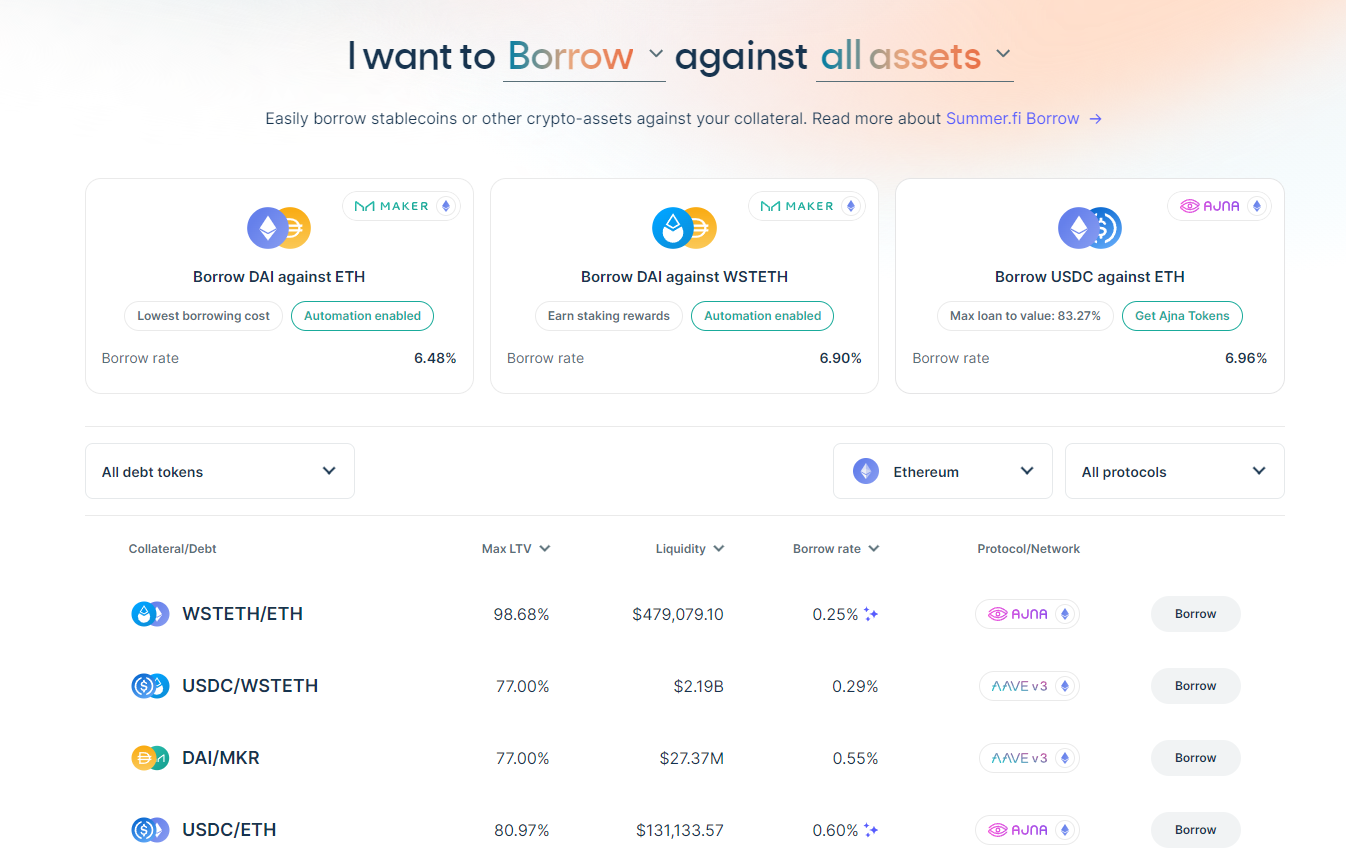

- Look for the most favorable borrow rate using Summer.fi's search tools.

- Calculate the liquidation price and ensure it's a risk you're comfortable with.

- Deposit your crypto, receive stablecoins, and convert them to fiat.

- Proceed to purchase your asset while managing your loan through Summer.fi.

Considerations:

Choosing a low borrow rate is crucial as it influences the cost of your purchase financing. The value of your crypto collateral may rise, potentially covering the loan repayment. However, a value decrease could necessitate additional funds to maintain the loan.

Let's do a real-world example:

John, aiming to buy a house worth $1 million without selling his 2500 ETH, opts for an ETH/DAI Borrow Vault on Spark Protocol. He purchases his house by borrowing $1M DAI, planning to repay as his wstETH appreciates.

Scenario 2: Exploring New DeFi Protocols

Thanks to token rewards, engaging with new DeFi protocols can be both educational and profitable. Borrow vaults enable you to use your preferred crypto assets without directly selling them.

How It Works:

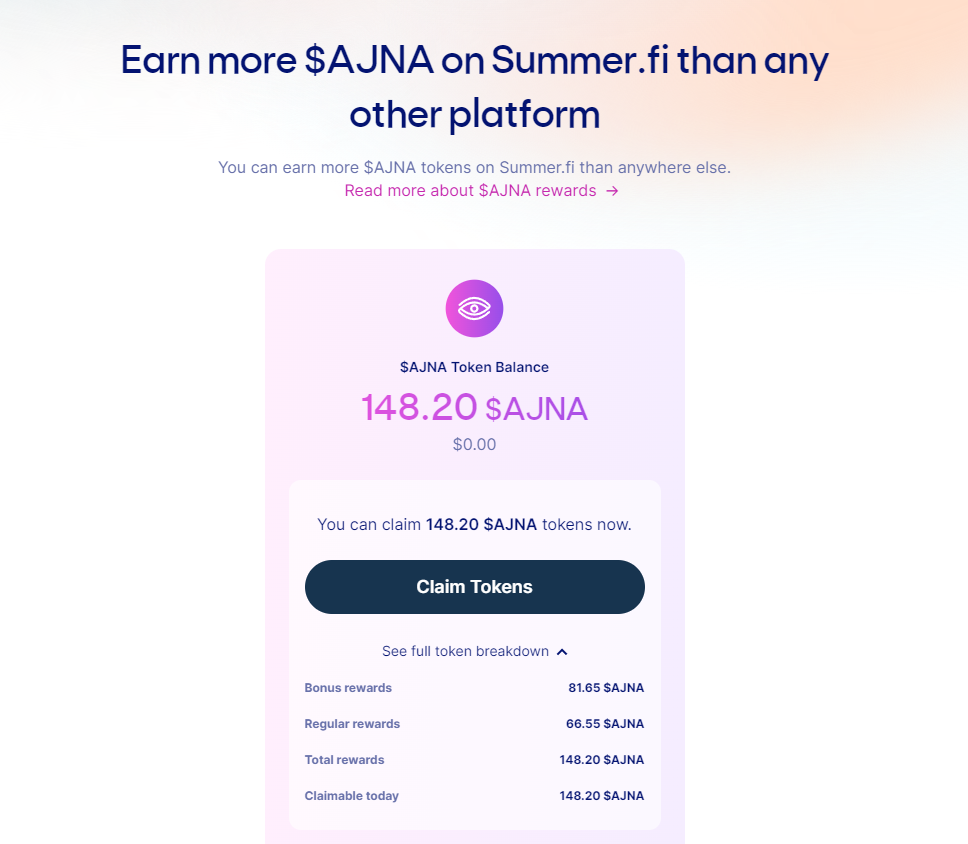

- Choose a rewarding protocol, like the AJNA Protocol.

- Calculate potential earnings versus borrowing costs.

- Select the necessary asset types and borrow rates.

- Deploy your borrowed tokens into the chosen protocol and reap the rewards.

Key Points:

Strategize carefully, considering risks and using trusted borrowing protocols to mitigate additional risks. This is where Summer.fi comes into play by curating this list of protocols you may use.

Scenario 3: Engaging in Carry Trades

Carry trades involve borrowing at lower costs to invest at higher returns. Summer.fi simplifies this process, focusing on the strategic aspects rather than operational challenges.

Implementation Guide:

- Use Summer.fi to find yield-bearing and borrow rates.

- Calculate the profit spread and monitor the returns over time.

Considerations:

Timing and additional costs, like transaction fees, are crucial for the profitability of carry trades.

Scenario 4: Unlocking Liquidity for Investments

For those eyeing under-the-radar opportunities with growth potential, borrowing against your crypto to fund these ventures can be a strategic move without liquidating your holdings.

How to Proceed:

- Identify the growth potential asset.

- Pick the most suitable borrow vault based on your criteria.

- Assess the investment size against the desired risk level.

Important Factors:

The borrow rate will affect your investment's net return—plan for scenarios where the investment might not yield expected returns.

In conclusion, you don't always need to sell your crypto; you can get value using Summer.fi by leveraging your investment and using it as collateral for a loan. All investments have risks attached, so plan your strategy correctly before executing.

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.